If you need to fill a financing pit amongst the school can cost you along with your federal support, then personal student loans may be the right solution. However, with the generally highest rates and you may insufficient debtor defenses, they always is practical so you can exhaust federal education loan options ahead of turning to personal loan providers. In order to meet the requirements, a borrower need to be a U.S. citizen and other eligible position and you will see financial underwriting requirements. The fresh borrower is required to satisfy applicable underwriting criteria considering certain financial conditions. Splash does not make sure you’ll get any loan now offers or that the application for the loan would be acknowledged. In the event the recognized, the genuine speed will be in this a selection of rates and you will is dependent upon many things, and label out of loan, a responsible credit history, earnings and other issues.

Pay day loan providers and money improve applications have fun with a few secret parts of info so you can approve you to have a payday advance on the internet otherwise an advance loan. Life salary to paycheck is tough sufficient instead of expensive emergencies developing. For individuals who’ve sick any other credit options, your final resort would be a payday advance loan otherwise payday cash advance.

Simply how much have a tendency to an excellent $20,100 mortgage prices?

Once you happen to be prequalified with a few lenders, contrast consumer loan costs and costs to find the best provide. Such as, unsecured loan identity lengths fundamentally vary from step 1 to help you 7 decades, even if it may vary by the financial. Think about your cost ability and the go out necessary to pay the loan so you can slim your search. Many of the mastercard now offers that appear on this web site come from creditors of which i receive financial settlement. Which compensation can get impact just how and you will where things show up on which webpages (as well as, for example, the order in which they look).

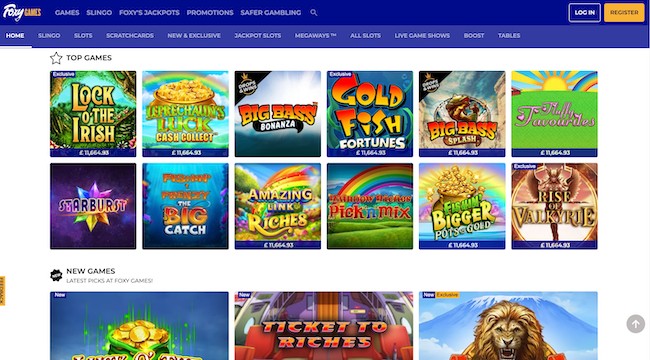

Discover more about bonuses provided by CashSplash Local casino

Unsecured loans try cost money that provides you with a lump sum of money, typically inside mrbetlogin.com click this link now days of applying (specific loan providers give exact same-day unsecured loans). Usually it’re unsecured, but some lenders create render security fund, and that involve you pledging a valuable asset in order to support the mortgage. You’ll often should make it fee since the a lump sum or, at most, over the course of 12 months.

Inside the Cash Splash, the brand new progressive jackpot is caused by landing 5 nuts icons (Dollars Splash image) to the 15th payline of your own games. That it combination of payouts and vintage symbols tends to make Cash Splash a great eternal slot to have participants looking for both frequent wins and you will a great attempt from the jackpot. The brand new icons to the reels realize a vintage slot machine game style, however, each one of these has its own unique payout possible.

The loan provider is generally prepared to deal with money you to waives a lot of the fees and penalties and you will costs, causing you to be together with your fundamental attention and you will fees to expend. You’ll should also has some other student loan so you can consolidate their defaulted financing. In case your defaulted student loan ‘s the only one you may have, your obtained’t be eligible for a combination mortgage. Your government Lead Consolidation Loan can get mortgage loan one to’s on average your former finance.

You secure that loan which have collateral, that could in addition to help you qualify otherwise lower your price. Refinancing or merging private and you can federal college loans is almost certainly not the right choice for everybody. Ahead of obtaining a personal education loan as a result of Splash, you should opinion all choices.

Prequalification isn’t an offer of borrowing, and your last speed can differ. Just be willing to wait a short while to locate your bank account, because the financing usually takes three to five days after accepted. Happy Currency have an a+ rating for the Bbb which is perfect for debt consolidation and mastercard integration finance. This guide examines just what qualifies since the a private student loan, just how private college loans works, and when to look at which loan type of.

Which deposit bonus of CashSplash Gambling establishment features a wagering requirement of 40-moments the value of your own incentive. To withdraw their payouts, you will want to bet at the least so it number of finance. For example, if one makes a real currency put worth €one hundred, might discovered a match extra from €150.

If you are private student loan interest levels are generally higher than the individuals away from federal student education loans, you can qualify for all the way down costs when you yourself have advanced borrowing from the bank. Individual student loans lack the dependent-within the borrower protections from government college loans. Simultaneously, to own individuals as opposed to advanced borrowing, individual student loans are apt to have higher rates of interest than simply government student education loans, which results in a high overall cost away from credit.

- You can also be eligible for federal gives, for instance the Pell Give, while you are an undergraduate college student which have exceptional monetary you need.

- We’re clear about how exactly we are able to offer quality content, competitive cost, and of use products to you from the detailing the way we profit.

- Cash advance and you will charge card bucks pros are a couple of sort of high-attention financial obligation to prevent.

- Do this for the tracking code that has been provided for you by the current email address on your own delivery confirmation and you can beginning advice out of Splash styles on line.

While not all of the lenders offer finance in order to consumers which have bad credit, those who manage makes it easier for borrowers in order to become approved by the considering points past a credit rating. Twenty-12 months mortgage loans will often have straight down prices than 29-12 months fund. An excellent $325,one hundred thousand real estate loan at the six.25% could have a payment away from $2,376. The fresh extended the mortgage identity, the greater amount of your interest impacts the fee number. A great $3 hundred,one hundred thousand financing that have a six.5% home loan rates will have a payment from $1,896. A speed decrease of 0.50 percentage items, in order to 6%, decreases the payment per month so you can $step one,799.

To help you be eligible for government figuratively speaking, you’ll want to finish the Totally free App to own Government Student Help (FAFSA). This type find their qualifications not just to own student loans however, but also for offers, scholarships and grants, and the federal functions-research program. From the contributing more the required payment, it is possible to decrease your mortgage balance shorter and you will spend quicker attention more than go out. Consider placing people unanticipated fund — for example taxation refunds, bonuses, or financial gifts — to the their student loan harmony. If you’re planning to pay off the figuratively speaking early, a rewards statement is essential. It gives a clear and you will accurate count must fully accept the debt, in addition to focus and one fees.

That is finest utilizes what you can qualify for, the cost of the applying, the place you order it, and also the payment per month you can afford. Usually, such prices try below those readily available thanks to private student education loans. Refinancing is even an option to remove monthly premiums and you may total credit will cost you when you can reduce your rate of interest. Although not, most individuals that have federal finance, and Head Money and FFEL program money, ought not to re-finance, because the performing this form letting go of government mortgage benefits. You will find five earnings-determined installment (IDR) agreements open to Head Financing borrowers.

In contrast, less credit score could possibly get boost your prices since the lenders find you much more attending standard on your own student loan debt. When you are precise criteria vary by program, people potential will assist repay one another government and private student education loans. Observe exactly what’s available in your neighborhood, visit your county’s Department away from Knowledge webpages otherwise speak to your top-notch organization. Those who lent away from Sallie Mae following this 2014 broke up have individual student loans, and that aren’t qualified to receive federal forgiveness apps. Yet not, Sallie Mae tend to discharge expenses to possess borrowers which pass away or be entirely and you may permanently disabled. Generally, the new centered-inside the debtor protections of government figuratively speaking make sure they are a attractive alternative.